Is it better to Rent… Or better to Own? Let’s explore…

Rent vs Own – The Ultimate Showdown

Recently I watched Gary Keller and Jay Papasan at Keller Williams Realty International share a stage at Mega Camp in Austin Texas and they shared a few interesting facts about the debate and the credibility of owning vs. renting. Here are some of the key takeaways from our time together.

Quite often, the powers at be, start pontificating about whether it is better to buy or better to rent. I believe that we can all agree, that many factors play a role in this equation as there is a downpayment, the interest that is paid for borrowing, any of the fees associated with that purchase, and the regular maintenance that goes along with owning a product vs. borrowing a product for a period of time. Let’s look at the most recent market cycle and break down a real-life case study based on the actual historical performance of this market cycle.

Rent vs Own over time…

In each of the three columns above, you go back in time to 2012 and make a different choice around homeownership, and here is how Gary and Jay explained the options and benefits.

You have three choices… they are Owning, Renting and Investing 100%, and Renting and Investing 10%.

1. Owning – You listen to your trusted Realtor partner. Instead of renting, you purchased a median-priced home for $177,200 with 10% down and paid about 4% in closing costs. And then for almost a decade, you let equity build-up through price appreciation and the forced savings of paying a mortgage.

2. Renting and Investing 100% – After reading an article on the merits of renting, you rented a median-priced place. You invested the unused 10% downpayment and the unpaid closing costs in an S&P 500 mutual fund. With incredible self-discipline, you invested 100% of your monthly savings (from renting instead of buying) in that same S&P 500 mutual fund. You did this for ten years and watched your stock portfolio grow.

3. Renting and Investing 10% – After reading an article on the merits of renting, you rented a median-priced place. You invested the unused 10% downpayment and the unpaid closing costs in an S&P 500 mutual fund. With more (ordinary) self-discipline, you invested 10% of your monthly savings (from renting instead of buying) in that same S&P 500 mutual fund. You did this for ten years and watched your stock portfolio grow.

So who wins? It depends. For a few years, renting can be a better choice. However, the balance tips toward homeownership’s favor between the third and fourth years. Even after all the additional costs, homeownership leaves renting in the dust after that. If you purchased the home, you came out with over $77,000 more in wealth than the superhuman who invested 100% of their savings, and over $126,000 more than the more-averagely-disciplined renter.

This outcome validates advice I’ve heard from real estate pros for the past twenty years…If you think you might be living in an area for at least three years, you should seriously explore buying.

Inside the Numbers

You probably have lots of questions about how they arrived at these numbers, so here you go…

For the homeownership path, we used actual appreciation for each year based on data from the National Association of Realtors. We estimated private mortgage insurance (PMI) at 0.5% of the mortgage until our equity reached 78% of the home value. We got to drop the PMI between year two and year three. We also estimated maintenance (0.1% of the home value per month), insurance (0.25% of the home value annually), and property taxes (2% of the home value annually). We also included appropriate buying costs at purchase and selling costs each year. So the “owning” column represents your net after all costs including commissions.

Two homeownership factors we did NOT include: the mortgage tax deduction (which has too many variables to estimate) and a hardware store addiction (which might include enough garden gnomes to undo your appreciation).

For the two renting paths, we assumed a one-month deposit and used CoStar’s annual median rents for “Class A Residential” costs. Rent started at $1,137/month and appreciated at a 3.6% rate for the decade. We did not account for renters’ insurance.

During this ten-year period, homeownership did great. We enjoyed an average annual rate of price appreciation of about 7.4%. That’s above the long-term trend line of 4%. However, the S&P 500 performed even better, averaging 15% annual growth. We used Yahoo Finance and our imaginary mutual fund has no annual fees. Take that, Vanguard!

Safe as Houses

Researching this article, Jay stumbled on some amazing research that kinda puts a bow on the front door of your home purchase. A 2017 working paper by the Federal Reserve Bank of San Francisco examined rates of return on treasury bills, bonds, equities, and residential real estate from 1870 to 2015. The headline: “Residential real estate, not equity, has been the best long-run investment throughout modern history.” They found both equities and housing averaged about a 7% ROI, but that equities were more than twice as volatile. No one expected T-bills or bonds to win. Low risk is expected to yield a lower return. Housing appears to warp the risk-reward relationship in its favor.

Whether you're looking at ten years or almost 150 years, homeownership comes with real financial benefits.

If you or someone you know, like, and care about are in the market to purchase your first home, a move-up/move-down home, or an investment property, please don’t keep me a secret. I would love to discuss the benefits of real estate to you, and them. You’ll be glad we met! Thank you for your time and for your willingness to hear me out.

Special thanks and gratitude to our leadership and to Jay Papasan for investing the time and resources to help paint the aforementioned picture.

Jay Papasan is Co-author of The One Thing & The Millionaire Real Estate Agent

Did your forbearance agreement just come due?

Who? What? When? How? Where…

All great questions!

With the end of the Cares Act, we are starting to field calls from owners around their forbearance agreements, and we it’s my understanding that some of these lump sum payments are quite large.

In most cases… there are a few options and solutions you should be aware of.

Option #1: Reinstatement… You bring in the balance of all missed payments due at one time, in one lump sum payment, and then you begin making your payments regularly moving forward.

Option #2: Work out a repayment plan… You pay your regular payment monthly along with a prorated amount of the balance of all missed payments on a monthly basis. Your payment effectively is increased until the balance of the forbearance amount is paid in full.

Option #3: There is a COVID-19 payment deferral option that may be available to you… This is a pretty cool option if you qualify. You are allowed to stack all the costs of the missed payments onto the back of the loan. This payment would be much like a balloon payment which would be due at the time your loan is paid off, at the time of sale, or at the time of your next refinance. There could be a slight increase in your monthly payment due to any taxes, insurance, or impounds that went unpaid during the forbearance agreement.

Option #4: Request a Loan Modification… There are a lot of opportunities and I will do my best to give you the jist of this.

If you can jump back in the game and make your monthly payment as it was before your stay in monthly payments, you may be able to work out an agreement with your lender to extend the terms of your loan to accommodate the necessary balance. Example… Before your forbearance agreement, you owed $500,000 on your loan, you had 24 years left to repay that debt, you hadn’t paid your mortgage in 24 months, and your payments were $2500.00/month. In essence, this means you owe the lender an additional $60,000 in principle, (interest and possible late fees), which would now go on the back of the loan making your new loan balance north of $560,000. In many cases, you would keep the payments the same and now your loan would have approximately 26 years left…

Another option may be for you to work out an agreement with your servicing company to revise the monthly payment, maybe extend the term of the loan, and in rare cases… reduce your interest rate. When I say extend the term of your loan, you may be able to have the loan extended for up to 40 years. This extension would thereby lower your monthly payments, making it easier for you to stay in your home. Now understand this… the probability of getting a lower interest rate is not very probable as rates were for all intents and purposes at all-time lows!

If you aren’t sure what Forbearance option works best for you, and you want to have a conversation with someone you can trust… give me a call or send me your information on my contact page, and feel good knowing I will do my best to help you through these challenging times.

Is It Safe to Get into the Real Estate Market?

How do you know if the timing is right to get in the real estate market… Experience shows that it all depends on YOU!

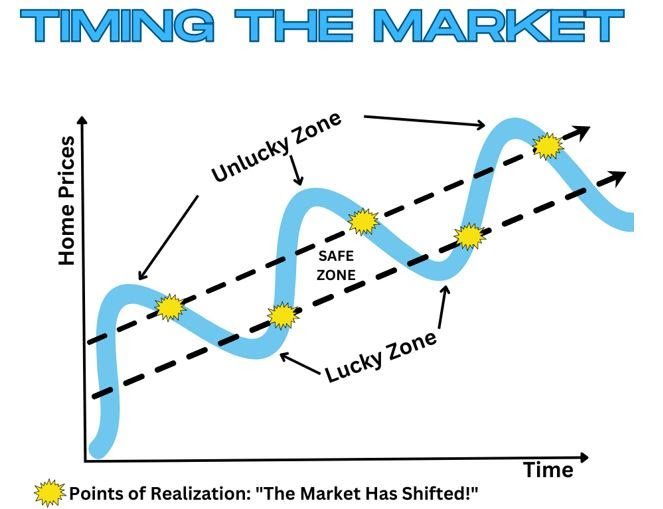

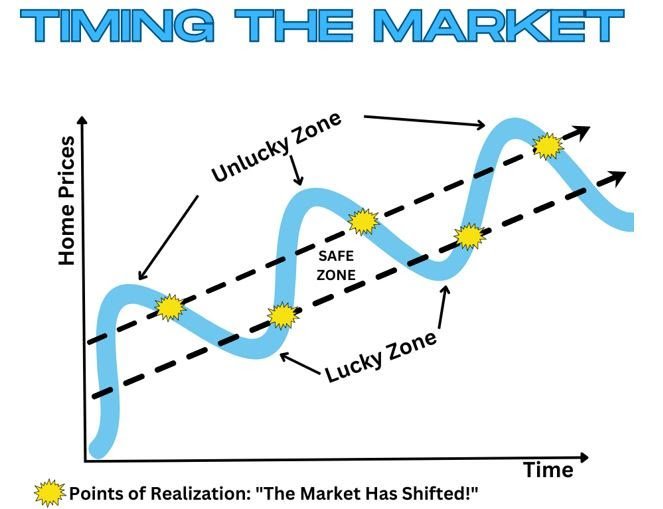

Our analysis suggests that we are very likely in that time right now. In a moment I’ll give you the numbers to support that. Yet, let me explain the graphic below regarding what we call the SAFE ZONE.

Timing the Market - The Safe Zone

As with the stock market, timing the real estate market looking for the bottom is more a matter of Luck than Skill. As the above graphic illustrates significant market shifts often aren’t realized till after they occur.

The biggest risk in waiting for the bottom is that when markets shift direction upward it often happens swiftly. We are experiencing a significant housing shortage locally and nationally. The swing up will likely find us in a hyper-active housing market where buyers have fewer choices, no negotiating leverage, and bidding wars for attractive homes.

Our analysis would indicate that we are clearly in the safe zone. We may see some further decline, yet the cost of being behind the upswing may represent the greater risk.

Orange County has already declined 13.4% from the pricing back in April of 2022. Active inventory has only increased by 4.3% while Pending sales have decreased by 33.5%. While these numbers seem bleak, they don't tell the entire story. There is no doubt... Orange County is still in a seller market with 1.7 months of inventory. In fact, in most markets right now, if a home is priced well and easy to show, we are still experiencing multiple offers in as little as 3-5 days on the market.

It's important to know that a recent article by Goldman Sachs predicted that the most overheated markets would likely see declines of 10-25%. As noted above, Orange County has already declined by 13.4% and we are clearly in that range today.

If you or someone you know are considering a real estate move in the next 12-24 months this may be the ideal time. We are clearly in the SAFE ZONE, particularly for anyone who intends to be in their home for an extended period.

Contact me today for a free no-obligation strategy session so we can explore your personal goals and address your specific situation to see if this is the right time for you.

A Historical Perspective on Interest Rates

Let’s look at where rates have been… A historical perspective

Real Estate - Mortgage Rates Annually

A Historical Perspective on Interest Rates:

Taking a look at the history of interest rates can provide valuable insights for today's home buyers. In recent years government stimulus as well as low inflation pressure held rates at artificially record low levels. Today’s interest rates, while by comparison feel high, are just above the 20-year historical average of 5.97% (see chart above).

Forecasting Interest Rates:

While predicting interest rates with absolute certainty is challenging, some indicators can help forecast future trends. Economic indicators, such as employment rates, GDP growth, and inflation, can provide clues about the direction of interest rates. Additionally, closely monitoring central bank policies and statements can offer insights into their stance on monetary policy. As your real estate advisor, I monitor these factors and can provide up-to-date information and guidance based on current market conditions.

Looking Ahead:

As we peer into the crystal ball, the next two years are expected to bring moderate increases in interest rates. However, it is crucial to remember that these forecasts are subject to change as economic conditions evolve. Home buyers should remain vigilant, stay informed, and be prepared to adjust their strategies accordingly.

Conclusion:

In today’s dynamic mortgage landscape, home buyers have an array of strategies and options to consider. Understanding interest rates, the impact of buy downs, and exploring alternatives like hard money loans can help buyers make informed decisions. By keeping a pulse on historical trends and staying updated on economic forecasts, home buyers can position themselves to secure the best possible mortgage terms. Remember, a well-crafted mortgage strategy is the key to unlocking the door to your dream home.

Today’s market offers unique opportunities for savvy home buyers and sellers. Should you have any plans to make a move in the next 12-24 months please contact me to schedule a no-obligation strategy session.